A | B | C | D | E | F | G | H | CH | I | J | K | L | M | N | O | P | Q | R | S | T | U | V | W | X | Y | Z | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9

Moscow, the financial center of Russia | |

| Currency | Russian ruble (RUB or руб or ₽) |

|---|---|

| Calendar year[1] | |

Trade organizations | WTO, BRICS, EAEU, CIS, GECF, APEC, G20 and others |

Country group |

|

| Statistics | |

| Population | |

| GDP | |

| GDP rank | |

GDP growth |

|

GDP per capita | |

GDP per capita rank | |

GDP by sector |

|

| |

Population below poverty line | |

Labor force | |

Labor force by occupation |

|

| Unemployment |

|

Average gross salary | RUB 76,604 / €700 per month |

| RUB 66,645 / €609 per month | |

Main industries | Complete range of mining and extractive industries producing coal, oil, gas, chemicals, and metals; all forms of machine building from rolling mills to high-performance aircraft and space vehicles; defence industries (including radar, missile production, advanced electronic components), shipbuilding; road and rail transportation equipment; communications equipment; agricultural machinery, tractors, and construction equipment; electric power generating and transmitting equipment; medical and scientific instruments; consumer durables, textiles, foodstuffs, handicrafts |

| External | |

| Exports | |

Export goods | Crude petroleum, refined petroleum, natural gas, coal, wheat, iron (2019) |

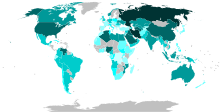

Main export partners |

|

| Imports | |

Import goods | Cars and vehicle parts, packaged medicines, broadcasting equipment, aircraft, computers (2019) |

Main import partners |

|

FDI stock | |

Gross external debt | |

| Public finances | |

| 3.8% of GDP (2022)[21] | |

| Revenues | 49.606 ₽ trillion[19] 33.22% of GDP (2022)[19] |

| Expenses | 53.038 ₽ trillion[19] 35.52% of GDP (2022)[19] |

All values, unless otherwise stated, are in US dollars. | |

The economy of Russia has gradually transformed from a planned economy into a mixed market-oriented economy.[27] It is classified by the World Bank as a high-income country.[28] It has enormous allocations of natural resources, particularly in terms of Russian natural gas and oil reserves, and thus significant economic power exists in its exports.[29] In 2023, it was the world's 11th-largest economy by nominal GDP, 6th-largest by purchasing power parity (PPP) according to IMF, and 5th-largest according to World Bank.[5] But in 2024 it turned out that World Bank uses obsolete data and in fact Russia was 4th-largest by PPP since 2021 and ever since.[30] Due to a volatile currency exchange rate, Russia's GDP as measured in dollars fluctuates sharply.[31] Russia was the last major economy to join the World Trade Organization (WTO), becoming a member in 2012.[32]

Russia's vast geography is an important determinant of its economic activity, with the country holding a large share of the world's natural resources.[33] It has been widely described as an energy superpower;[34] as it has the world's largest natural gas reserves,[35] 2nd-largest coal reserves,[36] 8th-largest oil reserves,[37] and the largest oil shale reserves in Europe.[38] It is the world's leading natural gas exporter,[39] the 2nd-largest natural gas producer,[40] the 2nd-largest oil exporter[41] and producer[42] and third largest coal exporter.[43] Russia's foreign exchange reserves are the world's 5th-largest.[44][unreliable source?] It has a labour force of roughly 70 million people, which is the world's 7th-largest.[45] Russia is the world's 3rd-largest exporter of arms.[46] The oil and gas sector accounted up to roughly 34% of Russia's federal budget revenues,[47] and up to 54% of its exports in 2021.[48][49]

Russia's inequality of household income and wealth has remained comparatively high over time, which has been significantly caused by the large variance between Russian geographic regions and their differing levels of energy reserves.[50] For instance, the nation's Gini coefficient was 36 in 2020 in comparison to the value of 39.8 in 2021 within the United States.[51] Russia has the world's 5th-largest number of billionaires.[52]

Following the 2022 Russian invasion of Ukraine, the country has faced extensive sanctions and other negative financial actions from the Western world and its allies which have the aim of isolating the Russian economy from the Western financial system.[53] Russia's economy has been affected by the sanctions, particularly in terms of increasing inflation. Yet it has appeared relatively resilient to such measures broadly, although military-related production has faced specific challenges such as in utilizing computer chips.[54][55][56][57]

History

The Russian economy has been volatile over the past multiple decades. After 1989, its institutional environment was transformed from a command economy based upon socialist organizations to a capitalistic system. Its industrial structure dramatically shifted away over the course of several years from heavy investment in manufacturing as well as in traditional Soviet agriculture towards free market related developments in natural gas and oil extraction in additional to businesses exploring mining. A service economy also expanded during this time. The academic analyst Richard Connolly has argued that, over the last four centuries in a broad sense, there were four main characteristics of the Russian economy that have shaped the system and persisted despite the political upheavals. First of all the weakness of the legal system means that impartial courts do not rule and contracts are problematic. Second is the underdevelopment of modern economic activities, with very basic peasant agriculture dominant into the 1930s. Third is technological underdevelopment, eased somewhat by borrowing from the West in the 1920s. And fourth lower living standards compared to Western Europe and North America.[58]

Russian Empire

This article has multiple issues. Please help improve it or discuss these issues on the talk page. (Learn how and when to remove these template messages)

|

The economy of the Russian Empire covers the economic history of Russia from 1721 to the October Revolution of 1917 (which ushered in a period of civil war, culminating in the creation of the Soviet Union).

Russian national income per capita increased and moved to closer to the most developed economies of Northern and Western Europe from the late 17th century to the 1740s.[59] After the 1740s, the Russian economy stagnated and declined. In the 18th century, Russian national income per capita was about 40–70% of British per capita income but higher than Poland's.[59] By 1860, Russian GDP per capita was similar to that of Japan; one-third of GDP per capita in the United States or the United Kingdom; and twice that of China or India.[59] Russia was a late industrializer.[59]

Serfdom, which held back development of the wage labor market and created a shortage of labor for industry, was abolished in 1861.[59] In the aftermath, GDP per capita was volatile and did not substantially increase.[59] Steady economic growth began in the 1890s, alongside a structural transformation of the Russian economy.[59] By the time World War I started, more than half the Russian economy was still devoted to agriculture.[59] By the early 20th century, the Russian economy had fallen further behind the American and British economies.[59] From the late 19th century to the early 20th century, the economy grew at a similar pace as the Japanese economy and faster than the Brazilian, Indian and Chinese economies.[59]

Despite all this Russian Empire from the beginning of the reign of Nicholas II, it began to change dramatically in economic terms. It was the fastest growing economy in the world,[60] the average GDP growth was higher than the Western European one, and the volume of production per capita was equal to it.[61] The standard of living also grew high.[62]Soviet Union

Beginning in 1928, the course of the Soviet Union's economy was guided by a series of five-year plans. By the 1950s, the Soviet Union had rapidly evolved from a mainly agrarian society into a major industrial power.[63] By the 1970s the Soviet Union was in an Era of Stagnation. The complex demands of the modern economy and inflexible administration overwhelmed and constrained the central planners. The volume of decisions facing planners in Moscow became overwhelming. The cumbersome procedures for bureaucratic administration foreclosed the free communication and flexible response required at the enterprise level for dealing with worker alienation, innovation, customers, and suppliers.

From 1975 to 1985, corruption and data manipulation became common practice within the bureaucracy to report satisfied targets and quotas, thus entrenching the crisis. Starting in 1986, Mikhail Gorbachev attempted to address economic problems by moving towards a market-oriented socialist economy. Gorbachev's policies of Perestroika failed to rejuvenate the Soviet economy; instead, a process of political and economic disintegration culminated in the breakup of the Soviet Union in 1991.

Transition to market economy (1991–98)

Following the collapse of the Soviet Union, Russia underwent a radical transformation, moving from a centrally planned economy to a globally integrated market economy. Corrupt and haphazard privatization processes turned over major state-owned firms to politically connected "oligarchs", which has left equity ownership highly concentrated.

Yeltsin's program of radical, market-oriented reform came to be known as a "shock therapy". It was based on the policies associated with the Washington Consensus, recommendations of the IMF and a group of top American economists, including Larry Summers[64][65][66] who in 1994 urged for "the three '-ations'—privatization, stabilization, and liberalization" to be "completed as soon as possible."[67] With deep corruption afflicting the process, the result was disastrous, with real GDP falling by more than 40% by 1999, hyperinflation which wiped out personal savings, crime and destitution spreading rapidly.[68][69] The jump in prices from shock therapy wiped out the modest savings accumulated by Russians under socialism and resulted in a regressive redistribution of wealth in favour of elites who owned non-monetary assets.[70]

Shock therapy was accompanied by a drop in the standard of living, including surging economic inequality and poverty,[71] along with increased excess mortality[72][73] and a decline in life expectancy.[74] Russia suffered the largest peacetime rise in mortality ever experienced by an industrialized country.[75] Likewise, the consumption of meat decreased: in 1990, an average citizen of the RSFSR consumed 63 kg of meat a year; by 1999, it had decreased to 45 kg.[76]

The majority of state enterprises were privatized amid great controversy and subsequently came to be owned by insiders[77] for far less than they were worth.[65] For example, the director of a factory during the Soviet regime would often become the owner of the same enterprise. Under the government's cover, outrageous financial manipulations were performed that enriched a narrow group of individuals at key positions of business and government.[78] Many of them promptly invested their newfound wealth abroad, producing an enormous capital flight.[79] This rapid privatization of public assets, and the widespread corruption associated with it, became widely known throughout Russia as "prikhvatizatisiya," or "grab-itization."[80]

Difficulties in collecting government revenues amid the collapsing economy and dependence on short-term borrowing to finance budget deficits led to the 1998 Russian financial crisis.

In the 1990s, Russia was a major borrower from the International Monetary Fund, with loan facilities totalling $20 billion. The IMF was criticised for lending so much, as Russia introduced little of the reforms promised for the money and a large part of these funds could have been "diverted from their intended purpose and included in the flows of capital that left the country illegally".[81][82]

On 24 September 1993, at a meeting of the Commonwealth of Independent States (CIS) Council of Heads of State in Moscow, Azerbaijan, Armenia, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Uzbekistan signed the Treaty on the creation of an Economic Union which reinforces by an international agreement the intention to create an economic union through the step-by-step creation of a free trade area, a customs union and conditions for the free movement of goods, services, capital and labor. All these countries have ratified the Treaty and it entered into force on 14 January 1994. Turkmenistan[83] and Georgia joined in 1994 and ratified the Treaty, but Georgia withdrew in 2009.[84]

On 15 April 1994, at a meeting of the Commonwealth of Independent States (CIS) Council of Heads of State in Moscow, all 12 post-Soviet states signed the international Agreement on the Establishment of a Free Trade Area in order to move towards the creation of an economic union. Article 17 also confirmed the intention to conclude a free trade agreement in services.[85] Article 1 indicated that this was "the first stage of the creation of the Economic Union", but in 1999 the countries agreed to remove this phrase from the agreement. [86] Russia concluded bilateral free trade agreements with all CIS countries and did not switch to a multilateral free trade regime in 1999. Bilateral free trade agreements, except for Georgia, Azerbaijan and Turkmenistan[87][88] (all of these are in force as of 2024), ceased to apply only after 2012 with Russia's accession to the new multilateral CIS free trade area.

Further integration took place outside the legal framework of the CIS. Pursuant to the Treaty on the creation of an Economic Union, the Agreement on the Customs Union between the Russian Federation and the Republic of Belarus was signed on 6 January 1995 in Minsk.[89] The Government of the Republic of Belarus and the Government of the Russian Federation, on the one side, and the Government of the Republic of Kazakhstan, on the other side, signed an Agreement on the Customs Union in Moscow on 20 January 1995 in order to move towards the creation of an economic union as envisaged by the treaty.[90] The implementation of these agreements made it possible to launch the Customs Union of the Eurasian Economic Community in 2010. According to the database of international treaties of the Eurasian Economic Union, these agreements are still in force as of 2024 and apply in part not contrary to the Treaty on the Eurasian Economic Union. [91][92][93]

International agreements such as the following have further deepened trade and economic relations and integration with Belarus. The Community of Belarus and Russia was founded on 2 April 1996. The "Treaty on the Union between Belarus and Russia" was signed on 2 April 1997. And finally the Treaty on the Creation of a Union State of Russia and Belarus was signed on 8 December 1999.

Recovery and growth (1999–2008)

Russia recovered quickly from the August 1998 financial crash, partly because of a devaluation of the ruble, which made domestic producers more competitive nationally and internationally.

Between 2000 and 2002, significant pro-growth economic reforms included a comprehensive tax reform, which introduced a flat income tax of 13%; and a broad effort at deregulation which benefited small and medium-sized enterprises.[94]

Between 2000 and 2008, Russian economy got a major boost from rising commodity prices. GDP grew on average 7% per year.[68] Disposable incomes more than doubled and in dollar-denominated terms increased eightfold.[95] The volume of consumer credit between 2000 and 2006 increased 45 times, fuelling a boom in private consumption.[96][97] The number of people living below poverty line declined from 30% in 2000 to 14% in 2008.[98][99]

Russia repaid its borrowing of $3.3 billion from the IMF three years early in 2005.[100]

Inflation remained a problem however, as the central bank aggressively expanded money supply to combat appreciation of the ruble.[101] Nevertheless, in 2007 the World Bank declared that the Russian economy achieved "unprecedented macroeconomic stability".[102] Until October 2007, Russia maintained impressive fiscal discipline with budget surpluses every year from 2000.[94]

2009–14

Russian banks were affected by the global credit crunch in 2008, though no long term damage was done thanks to proactive and timely response by the government and central bank, which shielded the banking system from effects of the global financial crisis.[103][104][105] A sharp, but brief recession in Russia was followed by a strong recovery beginning in late 2009.[68]

Between 2000 and 2012, Russia's energy exports fuelled a rapid growth in living standards, with real disposable income rising by 160%.[106] In dollar-denominated terms this amounted to a more than sevenfold increase in disposable incomes since 2000.[95] In the same period, unemployment and poverty more than halved and Russians' self-assessed life satisfaction also rose significantly.[107] This growth was a combined result of the 2000s commodities boom, high oil prices, as well as prudent economic and fiscal policies.[108] However, these gains have been distributed unevenly, as the 110 wealthiest individuals were found in a report by Credit Suisse to own 35% of all financial assets held by Russian households.[109][110] Russia also has the second-largest volume of illicit money outflows, having lost over $880 billion between 2002 and 2011 in this way.[111] Since 2008 Forbes has repeatedly named Moscow the "billionaire capital of the world".[112]

In July 2010, Russia, together with Belarus and Kazakhstan, became a founding member of the Customs Union of the Eurasian Economic Community (EurAsEC), and the EurAsEC Single Economic Space, a common market of the same countries, came into force on 1 January 2012, superseding the bilateral agreements on free trade. At the same time Russia's membership to the WTO was accepted in 2011.[113] Russia joined the World Trade Organization (WTO) on 22 August 2012 after 19 years of negotiations.[114][115][116] On 20 September 2012, the multi-lateral Free Trade Area of the Commonwealth of Independent States (CIS FTA) came into force for Russia and subsequently superseded previous bilateral agreements among 9 participating post-Soviet states.[117] In 2015, Russia became a founding member of the Eurasian Economic Union (EAEU), which replaced EurAsEC and envisaged a supranational economic union (the deepest stage of economic integration[118]).[119]

Rapid GDP and income growth continued until 2013. The most important topic of discussion in the economy for a decade was the middle-income trap. In 2013, the World Bank announced that Russia had graduated to a high-income economy based on the results of 2012[120][121][122] but in 2016 it was reclassified as an upper-middle income economy[123][124] due to changes in the exchange rate of the Russian ruble, which is a floating currency. While the UN Human Development Index, which assesses progress in the standard of living, health and education, ranks Russia among the 'very high human development' countries.[125][126]

Russian leaders repeatedly spoke of the need to diversify the economy away from its dependence on oil and gas and foster a high-technology sector.[127] In 2012 oil, gas and petroleum products accounted for over 70% of total exports.[128] This economic model appeared to show its limits, when after years of strong performance, the Russian economy expanded by a mere 1.3% in 2013.[68] Several reasons were proposed to explain the slowdown, including a prolonged recession in the EU, which is Russia's largest trading partner, stagnant oil prices, lack of spare industrial capacity and demographic problems.[129] Political turmoil in neighbouring Ukraine added to the uncertainty and suppressed investment.

2014–21

Following the annexation of Crimea in March 2014 and Russia's involvement in the ongoing War in Donbas, the United States, the European Union, Canada, and Japan imposed sanctions on Russia.[130] This led to the decline of the Russian ruble and sparked fears of a Russian financial crisis. Russia responded with sanctions against a number of countries, including a one-year period of total ban on food imports from the European Union and the United States.

According to the Russian economic ministry in July 2014, GDP growth in the first half of 2014 was 1%. The ministry projected growth of 0.5% for 2014.[131] The Russian economy grew by a better than expected 0.6% in 2014.[132] Russia is rated one of the most unequal of the world's major economies.[133]

As a result of the World Bank's designation of a high-income economy, Barack Obama issued a proclamation 9188: "I have determined that Russia is sufficiently advanced in economic development and improved in trade competitiveness that it is appropriate to terminate the designation of Russia as a beneficiary developing country effective October 3, 2014."[134] U.S. Customs and Border Protection (CBP) indicated that Russia formally graduated from the GSP program on 4 October 2014.[135]

As of 2015, real income was still lower for 99% of Russians than it was in 1991.[75]

The Russian economy risked going into recession from early 2014, mainly due to falling oil prices, sanctions, and the subsequent capital flight.[136] While in 2014 GDP growth remained positive at 0.6%,[137] in 2015 the Russian economy shrunk by 3.7% and was expected to shrink further in 2016.[138] By 2016, the Russian economy rebounded with 0.3% GDP growth and officially exited recession. The growth continued in 2017, with an increase of 1.5%.[139][140]

In January 2016, Bloomberg rated Russia's economy as the 12th most innovative in the world,[141] up from 14th in January 2015[142] and 18th in January 2014.[143] Russia has the world's 15th highest patent application rate, the 8th highest concentration of high-tech public companies, such as internet and aerospace and the third highest graduation rate of scientists and engineers.[141]

According to the British company BP (Statistical Yearbook 2018), proven oil reserves in Russia at the end of 2017 were 14.5 billion tonnes (14.3 billion long tons; 16.0 billion short tons), natural gas was 35 trillion cubic metres (1.2 quadrillion cubic feet).[144] Gold reserves in Russia's subsoil, according to the U.S. Geological Survey, were 5,500 tonnes (5,400 long tons; 6,100 short tons) at the end of 2017.[145]

In 2019, the Ministry of Natural Resources estimated the country's mineral reserves in physical terms. At the end of 2017, oil reserves were 9.04 billion tonnes (8.90 billion long tons; 9.96 billion short tons), gas reserves were 14.47 trillion cubic metres (511 trillion cubic feet), gold reserves were 1,407 tonnes (1,385 long tons; 1,551 short tons), and diamonds reserves were 375 million carats (75 tonnes). Then for the first time the Ministry evaluated the mineral reserves of Russia in terms of value. The value of oil reserves amounted to 39.6 trillion rubles, the value of gas amounted to 11.3 trillion rubles, coking coal amounted to almost 2 trillion rubles, iron ore amounted to 808 billion rubles, diamonds amounted to 505 billion rubles, gold amounted to 480 billion rubles. The combined value of all mineral and energy resources (oil, gas, gold, copper, iron ore, thermal and lignite coal, and diamonds) amounted to 55.24 trillion rubles (US$844 billion), or 60% of GDP for 2017. The assessment occurred after the adoption of a new classification of reserves in Russia and the object of the methodology was only those fields for which a license was issued, so the assessment of the Ministry of Natural Resources is less than the total volume of explored reserves. Experts criticized such "an unsuccessful attempt to estimate reserves," pointing out that "one should not take such an estimate seriously" and "the form contains an incorrect formula for calculating the value".[146][147]

2022–present

In 2022, there have been heavy sanctions due to the Russian invasion of Ukraine that will likely result in steep recession.[149] Since early 2022 many official economic statistics are not published.[150] Sanctions also included asset freezes on the Russian Central Bank,[151] which holds $630 billion in foreign-exchange reserves,[152] to prevent it from offsetting the effects of sanctions.[153]

According to most estimates, every day of the war in Ukraine costs Russia $500 million to $1 billion.[154][155][156]

On 27 June 2022, Russia defaulted on part of its foreign currency, its first such default since 1918.[157]

In November 2022, it was reported that Russia had officially entered a recession as the Federal State Statistics Service had reported a national GDP loss for the second consecutive quarter.[158]

As part of the sanctions imposed on Russia, on 2 September 2022, the finance ministers of the G7 group agreed to cap the price of Russian oil and petroleum products, designed to allow Russia to maintain production, but limiting the revenue from oil sales.[159][160]

In 2022, The Economist calculated that Russia did graduate into the category of high-income economies by 2022, if counted at purchasing power parity rather than the exchange rate but could fall below the threshold because of invasion of Ukraine.[161] In December 2022, a study at the Bank of Russia's Research and Forecasting Department, found that the import dependence of the Russian economy is relatively low, does not exceed the median for other countries and the share of imports in most industries is lower than in other countries. The key explanation for this could be the low involvement of the Russian economy in global value supply chains and its focus on production of raw materials. However, 60% of Russia's imports come from the countries that have announced sanctions against Russia.[162]

TASS reported poor results for the Russian economy for quarter 1 2023 with revenues of 5.7 trillion roubles – down 21% (mainly due to falling oil revenues), expenditure 8.1 trillion roubles – up 34% (mainly due to increased military costs), creating a deficit 2.4 trillion roubles – ($29.4 billion)[163]

Following Central Bank of Russia interventions, the exchange rate of rouble against the dollar remained relatively stable in 2022, although in 2023 it started to decrease significantly, reaching RUB 97 per USD 1 on 15 August 2023. Both the interventions and the exchange rate decrease resulted in significant criticism of the Central Bank by Russian state propaganda.[164] Quarter 2 of 2023 saw a 13% fall in the value of the rouble against the dollar and a current account surplus estimated in to be falling by 80% from the annual 2022 surplus of $233 billion.[165]

After 11 years of negotiations, on 8 June 2023, in Sochi, Armenia, Belarus, Kazakhstan, Kyrgyzstan, Russia, Tajikistan and Uzbekistan signed the Commonwealth of Independent States Agreement on Free Trade in Services, Establishment, Operations and Investment to partly integrate Uzbekistan and Tajikistan on the common standards of the WTO (General Agreement on Trade in Services) and the EAEU (some provisions were borrowed from EAEU law) even without their membership in the WTO (Uzbekistan) or the EAEU (Uzbekistan and Tajikistan).[166] The Treaty on the Eurasian Economic Union has preserved international agreements on trade in services in the sphere of national competence of the member states therefore, the EAEU is not a party to the agreement.

In August and September 2023, the Central Bank of Russia started raising the key lending rate, ending up at 13% in September, while USD to RUB exchange rate remained at RUB 95.[167] As of June 2023 share of Russia's exports to EU dropped to 1.7% while Russia's imports from EU dropped to 1.5%.[168] In October 2023 the "psychological barrier" of RUB 100 per USD 1 was crossed.[169]

The 2024 budget expects revenues of 35 trillion rubles ($349 billion) with expenditure of 36.6 trillion, based on a Urals oil forecast of $71.30 per barrel, a 90.1 rubles to USD 1 exchange rate and inflation of 4.5%. Defence spending will double to 10.78 trillion, 29.4% of expenditure. Russia currently has a record low unemployment rate of just 3 percent.[170]

-

Gross domestic product (PPP) per capita in April 2022

-

Unemployment rate of Russia since the fall of the Soviet Union

-

Russian inflation rate 2012–2022

Data

The following table shows the main economic indicators in 1980–2023.[171]

| Year | GDP

(in billion. US$PPP) |

GDP per capita

(in US$ PPP) |

GDP

(in billion US$nominal) |

GDP per capita

(in US$ nominal) |

GDP growth

(real) |

Inflation rate

(in Per cent) |

Unemployment

(in Per cent) |

Government debt

(in % of GDP) |

|---|---|---|---|---|---|---|---|---|

| 1992 | 1,602.6 | 10,805.2 | 71.6 | 482.8 | n/a | n/a | 5.2% | n/a |

| 1993 | n/a | |||||||

| 1994 | >Text je dostupný pod licencí Creative Commons Uveďte autora – Zachovejte licenci, případně za dalších podmínek. Podrobnosti naleznete na stránce Podmínky užití. čítajte viac o Real_estate_in_Russia

Text je dostupný za podmienok Creative

Commons Attribution/Share-Alike License 3.0 Unported; prípadne za ďalších

podmienok. |